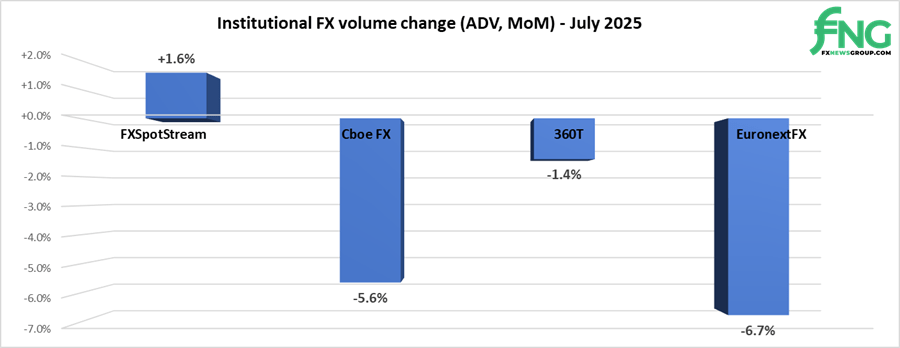

Institutional FX trading volumes slow 3% in July 2025

The traditional summer slowdown has hit the FX trading world, with July 2025 volumes slumping slightly from June levels, as traders hit the vacation trail and as currency volatility remained fairly low.

Each Cboe FX, EuronextFX and Deutsche Borse’s 360T reported trading volumes declines of between 1% and 7% MoM July 2025, although FXSpotStream did record a 1.6% increase in activity – all in averaging a decline of 3.1% from June.

Cboe FX (formerly HotspotFX)

- July 2025 average daily volumes were $45.59 billion, -5.6% from June’s $48.31 billion.

EuronextFX (formerly FastMatch)

- July 2025 ADV $25.79 billion, -6.7% from June’s ADV of $27.66 billion.

FXSpotStream

-

In July, FXSpotStream’s overall ADV was USD104.225billion an increase of 1.56% MoM. This consisted of a Spot ADV of USD68.394billion and USD35.831billion in other products (a new high on the Service).

-

Year to date, FXSpotStream’s Overall ADV (for the period January-July 2025) is up 26.25% when compared to the same period last year.

-

FXSpotStream’s Total ADV MoM (Jul’25 vs Jun’25) increased 1.56%

-

FXSpotStream’s Total ADV YoY (Jul’25 vs Jul’24) increased 12.34%

-

FXSpotStream’s Spot ADV MoM (Jul’25 vs Jun’25) increased 1.64%

-

FXSpotStream’s Spot ADV YoY (Jul’25 vs Jul’24) decreased 0.04%

-

FXSpotStream’s Other ADV MoM (Jul’25 vs Jun’25) increased 1.40%

-

FXSpotStream’s Other ADV YoY (Jul’25 vs Jul’24) increased 47.09%

360T

- Average daily volumes (ADV) at 360T came in at $33.42 billion in July 2025, down 1.4% from June’s $33.89 billion.