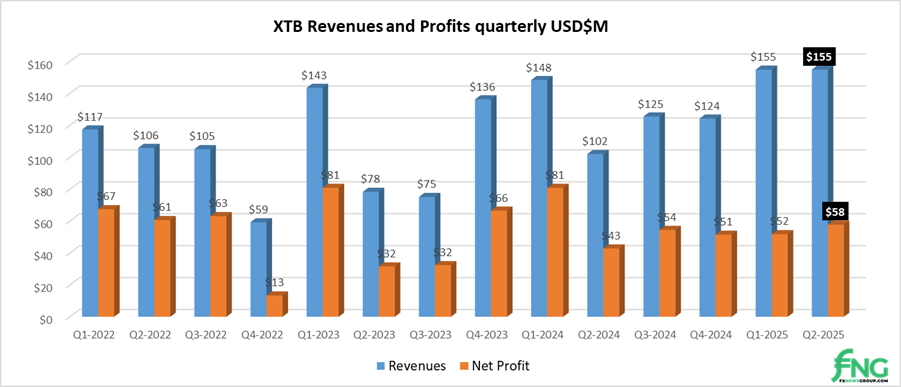

XTB revenue flat ($155M) but Profits up 11% ($58M) in Q2 2025

Poland based Retail FX and CFDs broker XTB (WSE:XTB) has released its preliminary results for Q2 and the first half of 2025, reporting a second consecutive strong quarter for the company.

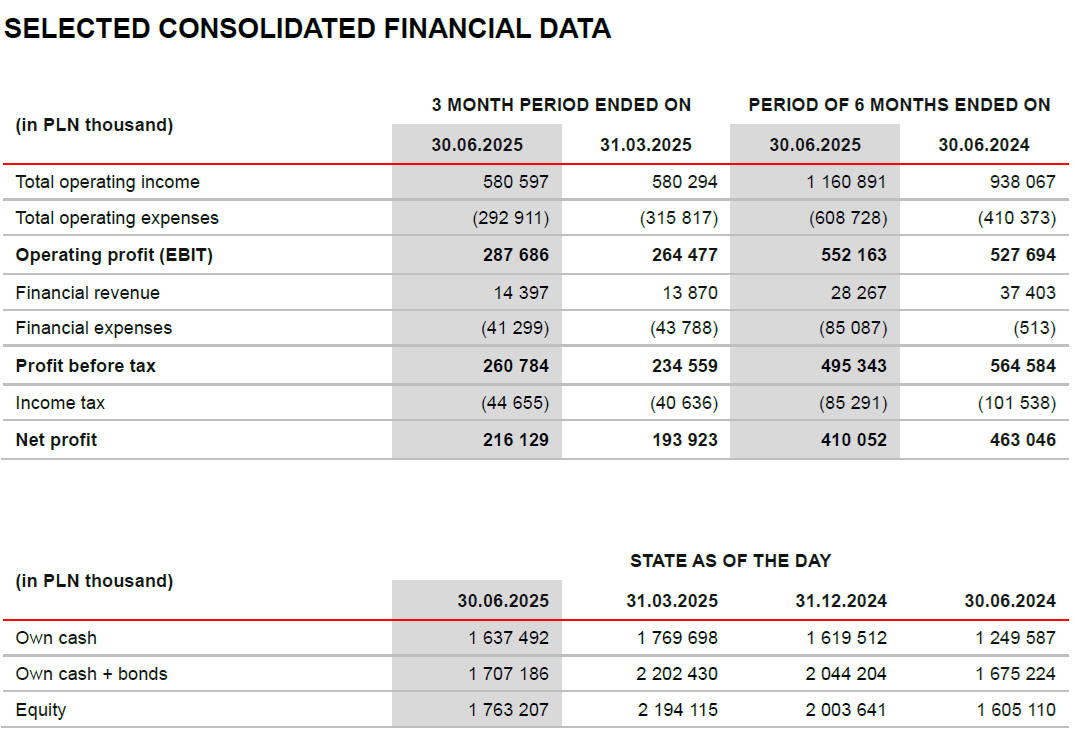

XTB Revenues and Profits Q2 2025

Revenues at XTB for the second quarter of 2025 came in at PLN 580.6 million (USD $155 million), virtually identical to Q1’s PLN 580.3 million result, which was a record quarter for XTB. Net Profit however was up by 11% in Q2, at PLN 216 million ($58 million) versus PLN 194 million in Q1.

XTB said that the second quarter of 2025 began with very high volatility caused by President Donald Trump’s trade war. In the following weeks, the market noticeably calmed down and began a path back to the levels seen at the end of the first quarter of 2025.

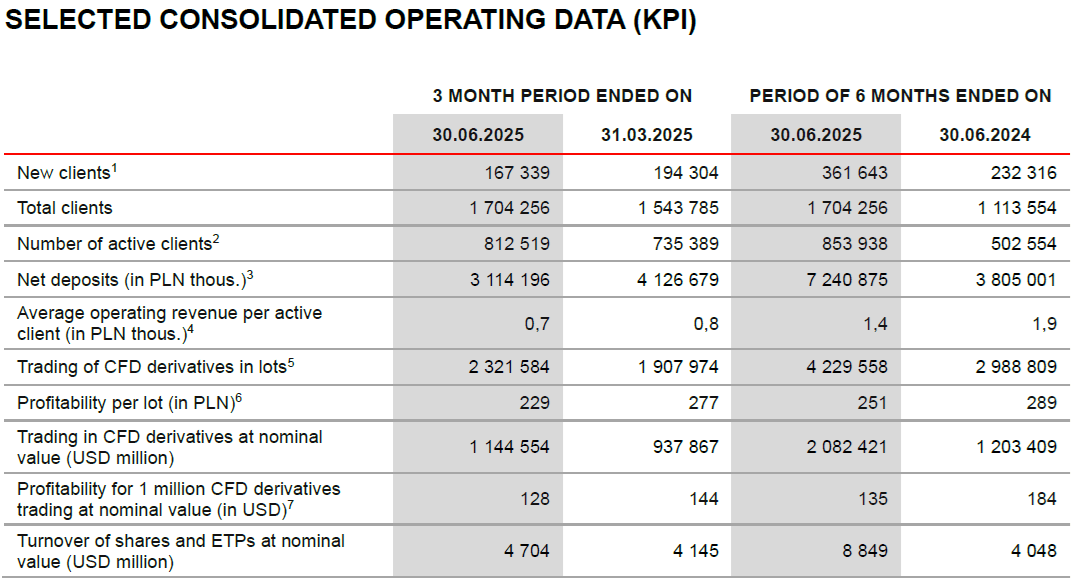

XTB Trading Volumes Q2 2025

Trading volumes at XTB averaged a record $382 billion monthly in Q2-2025, up 22% from $313 million per month in Q1. The company’s profitability per 1 million USD transaction volume in Q2 however fell to 128, from 144 in Q1.

XTB Client Acquisition 1H 2025

XTB said that it has a solid foundation in the form of an ever-growing base and number of active clients. In H1 2025, the Group recorded another record in this area by acquiring 361 643 new clients compared to 232 316 a year earlier, an increase of 55.7%. Similarly to the number of new clients, the number of active clients was also at a record high and increased from 502 554 to 853 938, i.e. by 69.9% y/y.

XTB Asset Classes Traded 1H 2025

Looking at the structure of the revenues generated in terms of instrument classes, in H1 2025 the dominant position was held by CFDs (contracts for difference) based on indices. Their share in the overall revenue structure amounted to 46.3%, compared to 37.2% in the corresponding period of the previous year. This was primarily the result of high profitability of transactions on instruments based on the US 100 index, the German DAX (DE40) index, and the US 500 index.

The second most profitable asset class were CFDs based on commodities, which accounted for 33.1% of revenue, compared to 48.2% in the first half of 2024. This result was driven by the high profitability of CFD transactions related to gold, crude oil, natural gas, and coffee prices. CFDs based on currencies represented 15.6% of revenues, compared to 10.3% in the corresponding period of the previous year. The most profitable financial instruments in this class were CFDs based on the EURUSD currency pair and the cryptocurrency Bitcoin.

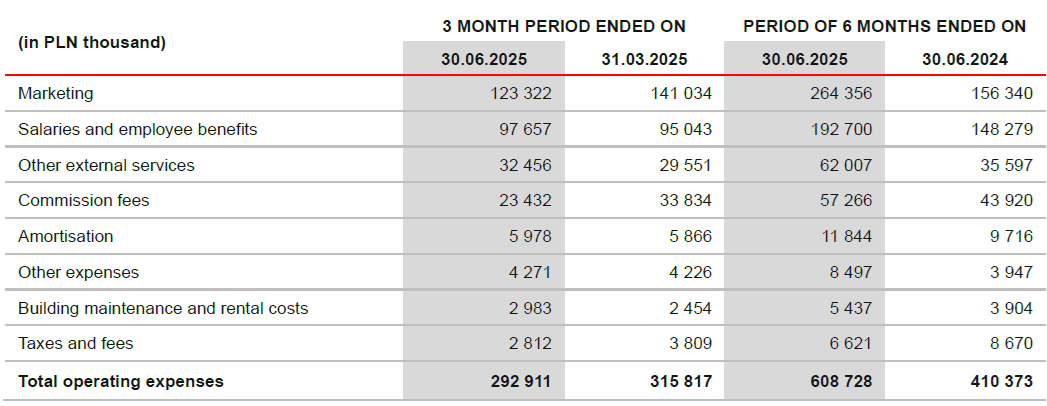

XTB Expenses Q2 2025

Quarter-on-quarter (q/q), operating expenses decreased by PLN 22.9 million. The main reason for this decline was a PLN 17.7 million reduction in marketing expenditures, both offline and online. Additionally, commission costs related to fees paid to payment service providers, through whom clients deposit funds into their trading accounts, decreased by PLN 10.4 million. This was the result of a change in the settlement model for these fees, which contributed to cost savings on XTB’s side. In the second quarter of 2025, other external services increased by PLN 2.9 million, mainly due to higher legal and consulting service costs, and employee compensation and benefits expenses rose by PLN 2.0 million as a result of increased staffing.

More highlights from XTB’s Q2 2025 results follow below.