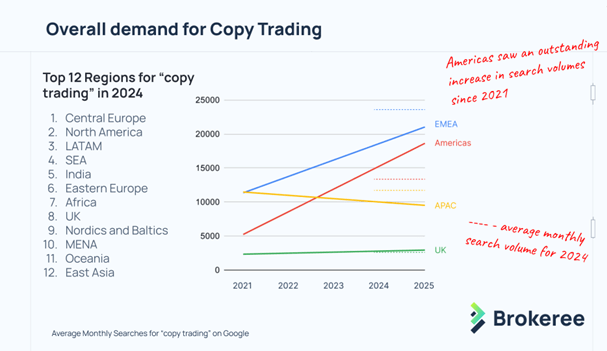

Top 12 regions with the highest demand for social trading services

In recent years, the demand for copy trading services has surged. Online searches for copy trading services have grown approximately 20% year-over-year (YoY) over the past four years, according to open data collected in the research conducted by Brokeree Solutions. By mid-2024, this demand reached historical records and achieved the highest Google search frequency ever. It’s important to note that this data only includes searches conducted in English, excluding those in native languages.

This burgeoning interest, however, is not uniform across the globe. Certain regions exhibit a markedly higher demand, offering lucrative opportunities for brokers looking to expand their market presence and cultivate a new, loyal customer base.

So, which regions are leading this trend?

Drawing from the average monthly Google searches for “copy trading,” here is a list of the top 12 regions in 2024 where interest is the highest.

Top regions with a growing demand for social trading services

Central Europe stands out prominently on this list. Traditionally, social trading services were believed to be more popular in regions with emerging online trading industries. However, Central Europe, with its well-established financial markets and sophisticated trader base, challenges this assumption. The region’s mature market infrastructure and a culturally ingrained interest in innovative financial products make it perfect for copy trading. This reflects a broader appetite for diverse trading strategies among European traders keen to integrate cutting-edge financial tools into their portfolios.

The Americas, encompassing both North America and Latin America (LATAM), have seen a significant growth in demand. These regions hold the second and third positions on the highlighted rating list, respectively. Notably, if Central Europe is the leader of the rating in absolute search numbers, then the Americas is the leader in terms of growth rates.

While proprietary trading remains highly popular in the USA, the rise in interest for copy trading is also growing. This market state may be explained in several ways.

Despite the high interest for prop trading in the USA, the North American region is in the top three for searches for “copy trading” services. This proves once again that these two trends are not competing, but complementary. First of all, this may be explained by demographic reasons: the average ages of users who prefer copy trading and prop trading are different. So, the audiences of these trading practices hardly intersect.If established brokers want to extend their clientele, the most efficient strategy for them is to offer both copy and prop trading.

Moreover, brokers can use trading challenges to qualify signal providers by combining the strength of these trends.

Remarkably, EMEA and the Americas have shown a consistent increase in interest since the pandemic. This trend has continued at similar rates in the past few years. Certainly, the pandemic catalyzed a shift in how people engage with financial markets, as lockdowns and economic uncertainties prompted many to explore alternative income streams and investment opportunities, including copy trading. The emerging interest is now sustained and indicates a permanent change in trading behaviors and preferences.

Regions with Static Demand

The demand for copy trading services remains relatively stable in regions like APAC and the UK. The graph for these two regions looks almost stable. The UK exhibits a slow but steady growth trajectory, while APAC shows a slight long-term decline. This decline is only due to the countries of the Southeast Asia region — all other countries in Asia-Pacific as well as other regions of the world experience an increase. Despite such a decrease in the Southeast Asia region, Asia-Pacific still has a considerable amount of search volume.

Brokers should keep in mind the demand for copy trading services varies across different countries even within these major regions. If demand is correcting in some countries after a sharp increase, it may increase in neighboring countries at the same time. That’s why it is so important for brokers to use advanced technologies that can share trading signals between servers, uniting all broker clients into the united investor pool.

Technologies and opportunities

Cross-server and cross-platform performance with low latency is essential for modern brokerage operations. Maintaining robust and stable technology is crucial for brokers risk management and reputation, especially during periods of high market volatility, as it directly impacts a broker’s operational efficiency.

On the 6th of January 2025, Brokeree Solutions announced the launch of the cross-platform version of its flagship Social Trading solutions supporting cTrader operation. Now, all brokers using this technology can introduce copying between two trading platforms without technological limitations to their clientele.