eToro targeting $3.5 billion+ valuation in London or New York IPO

eToro CEO Yoni Assia was quoted over the weekend in UK business news site Financial Times (ft.com) saying that the company is considering going public in an IPO this year, after seeing client trading volumes rise in recent weeks to “levels of activity that we haven’t seen since 2021.”

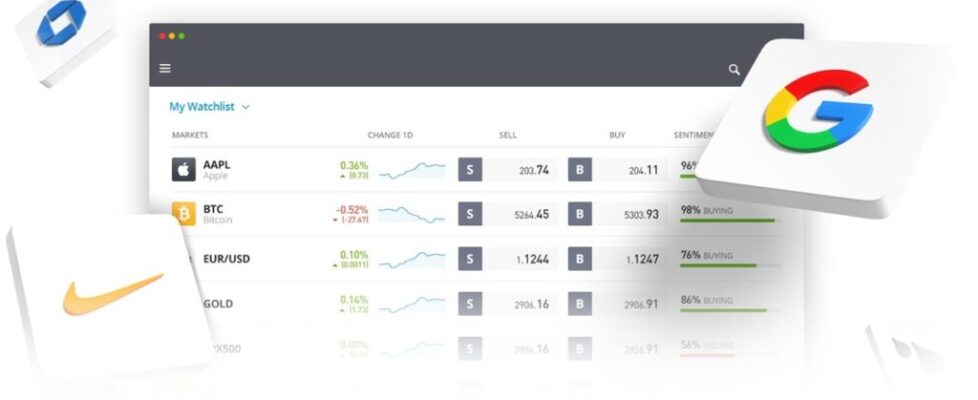

That trading activity at social-trading focused eToro is rising shouldn’t come as too much of a surprise, as the online broker seems to have done very well over time with the crypto trading crowd. Crypto trading among retail traders has picked up in early 2024, as Bitcoin and Ether prices have come roaring back. Bitcoin briefly topped the $70,000 level late last week setting an all-time high, while Ether has been approaching $4,000 for the first time since late 2021.

According to Assia, eToro has not yet decided where to go public, weighing alternatives that include New York (either the NYSE or NASDAQ), and London. He also mentioned that the company is targeting a valuation of at least $3.5 billion – well below the $10 billion valuation eToro tried to go public at in 2021-2022 via a SPAC merger (which ultimately failed to materialize), but above eToro’s recent private market valuation in a series of share sales made last summer by employees and long-term investors.

Assia had made similar comments regarding an eToro IPO last month to US business source CNBC, but without specific location or valuation detail.

Our own analysis (absent updated financials for eToro) at the time of the CNBC interview was that a valuation of between $540 million to $1.58 billion for eToro made more sense. The best comp for eToro is probably another Israel based online broker, Plus500 (LON:PLUS), which has a similar Revenue base as eToro – $726 million in 2023, versus a reported $630 million for eToro, which was nearly identical to the company’s Revenue base in 2022. Plus500 is trading at a market capitalization of about £1.45 billion (USD $1.84 billion), or about 2.5x LTM Revenues and 5.4x EBITDA. Using those metrics on eToro would result in a valuation range between $540 million to $1.58 billion for eToro, as noted above.