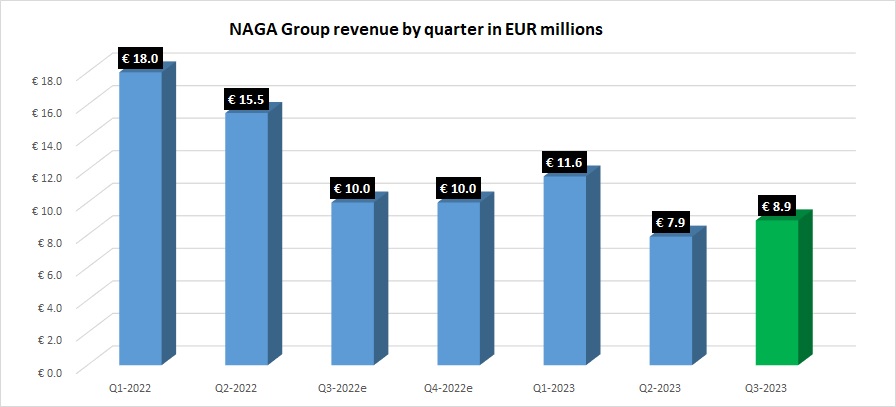

NAGA Group revenues stabilize in Q3 at €8.9M

After seeing a 32% Revenue decline in Q2 which (in part) led to the ouster of its CEO Ben Bilski, social trading focused online broker NAGA Group (ETR:N4G) has reported that things have stabilized and improved somewhat in Q3.

NAGA has reported that it saw Revenue of €28.4 million for the first nine months of 2023, meaning that Q3 Revenue totaled €8.9 million, after a multi-year low €7.9 million quarter in Q2. However Revenues remain well below the €10 million+ per quarter level which NAGA brought in throughout 2022, and in Q1 of 2023.

Interestingly, NAGA has yet to release its full year 2022 audited results, which the company now says is expected to be published by mid November.

Looking at the first three quarters of 2023, the Group’s preliminary EBITDA improved to €4.2 million, a significant achievement from the previous year’s loss of €-4.2 million in the same period. Furthermore, the Group reported preliminary year-to-date sales of €28.4 million through September 30th 2023 from its brokerage business, as noted above, delivering an EBITDA ratio of around 15%.

The company said that one of the key factors contributing to this growth is the reduction in operational and marketing costs. The NAGA Group has also expanded its presence in new and emerging markets, capitalizing on the increasing popularity of social investing and e-payments.

Reduced marketing spend

NAGA stated that a notable achievement in the first nine months of 2023 is the highly successful optimization of NAGA’s user acquisition strategy. Within the first nine months of 2022, the Group spent an estimated €26 million on marketing and sales, whereas in 2023, the expenditure was significantly reduced to €4 million in the same period. It is worth highlighting that the average net acquisition cost per new account improved drastically, decreasing from €1,269 on average in the first nine months of 2022 to €181 on average for the same period in 2023. The Group acquired around 10,000 new funded accounts in the first three quarters 2023 compared to 12,500 new funded accounts in the same period of 2022, a drop of only 19% despite reducing its acquisition budget by more than 83%.

NAGA Group trading volumes

Furthermore, comparing the first three quarters 2023 to 2022 all core KPIs have grown. Especially active accounts stand at 20.4K active traders in 2023 vs. 17.7K for the same period in 2022. Traded volume in 2023 grew to €110 billion (or about USD $13 billion in monthly trading volume in 2023YTD) vs. €98 billion alongside 7.3 million executed transactions compared to 6.2 million in the first nine months of 2022.

Client equity as of September 30th 2023 increased by 47% to €34 million from €23 million on 30th September 2022.

The new equity contribution from new accounts rose significantly from €6.2 million to €8.9 million, an increase of 42%. This translates to €913 per new account, an 105 % increase compared to the same period the previous year. Lastly, the average monthly churn rate improved from 8.4% in the first three quarters of 2022 down to 5.3% for the same period in 2023.

Additionally, the Group reports that its Neo-Banking App, NAGA Pay, has shown a double-digit growth in each quarter 2023, reaching a group wide revenue contribution of €0.25 million in 2023 and plans to break even in Q4 as a standalone project.

Management stated that NAGA Group’s strong financial performance in the first nine months of 2023 showcases its successful business strategy, including cost optimization, expansion into new markets and efficient user acquisition while improving client lifetime and churn metrics, which directly impact profitability.

Michael Milonas, Chief Executive Officer, noted,

“We have spent and hired in recent years according to established, capital intensive market standards, as has happened with many industry peers and tech companies. Our focus this year has been to reduce spending and increase efficiency. Spending 80% less and seeing growth across all our core KPIs makes us confident for the upcoming months.”

NAGA said it further continues its expansion into new markets by launching numerous partnerships and the opening of new branches. HY1 2023 has been a period of development in the Group’s Infrastructure to offer a framework for success in the emerging markets. A focus on acquisition, payments and regulations will provide the base for further success in HY2.

Sam Chaney, Chief Commercial Officer at NAGA, added,

Sam Chaney, Chief Commercial Officer at NAGA, added,

“We are committed to expanding our presence in Asia, Middle East, Africa, and Latin America by leveraging strategic partnerships with proven leaders in those regions. Our focus is not just on growth, but on building the right regulatory frameworks and infrastructure to deliver a first-class experience for our clients and partners. Understanding the local market needs is essential to our success, and we aim to create the right infrastructure for long-term success. This global growth story has only just started but significant inroads have already been made in a very short amount of time.”

Hamburg based NAGA Group operates offshore (Seychelles) site naga.com and CySEC-licensed nagamarkets.com.